|

Using NeuroShell Classifier for

Fundamental Stock Selection

There are some major companies who make their stock

selections every day using the NeuroShell Classifier. Although we helped these

companies and are non-disclosed to tell you who they are, what we taught them to

do is very easy, and anyone can do it.

The hardest part of the

process is obtaining good, clean, fundamental data on a fairly large number of

stocks. We are not talking about just price data or transformations of price

data like moving averages and stochastic indicators. That sort of analysis is

called technical analysis and is best done with our

NeuroShell Trader software.

We are talking instead about such fundamental factors as revenue growth, long

term debt, insider trading, dividend yields, etc.

Many companies provide this

data for a fee, with varying degrees of cleanliness. One of the best sources as

of this writing, according to some of our customers, is the American Association

of Individual Investors (AAII) www.aaii.com.

If you join you get access to their database, which has dozens of fields for

thousands of stocks, and the price is very reasonable.

You’ll need to collect data

on at least several hundred stocks, and that data needs to be at least 3 months

old. That’s because the neural net will need to evaluate how well the stock has

done over the last 3 months (or you can use 6, 12, whatever you want) in terms

of the fundamental data available at the beginning of that time.

You load your fundamental

data into a spreadsheet, each stock on a different row. You can have several

rows for the same stock if each row represents fundamental data on that stock at

different quarters. The columns contain the fundamental data variables (you can

use technical variables too), and you

create one column that describes how the stock performed over the next 3 months

(or 6, 12, whatever). You may need to clean up bad data, or eliminate fields

where the data is suspect or largely missing.

Next you start training nets

with the NeuroShell Classifier. This may be an iterative process, where you

choose to eliminate some variables that the Classifier tells you are not useful.

You may make more variables, using calculations on the existing ones. When you

are done, you have a model that, given recent fundamental data, gives you

probabilities that each stock will perform well in the next 3 month period (or 6

or 12).

At each stage of this

process, you will have free access to our experts to help you.

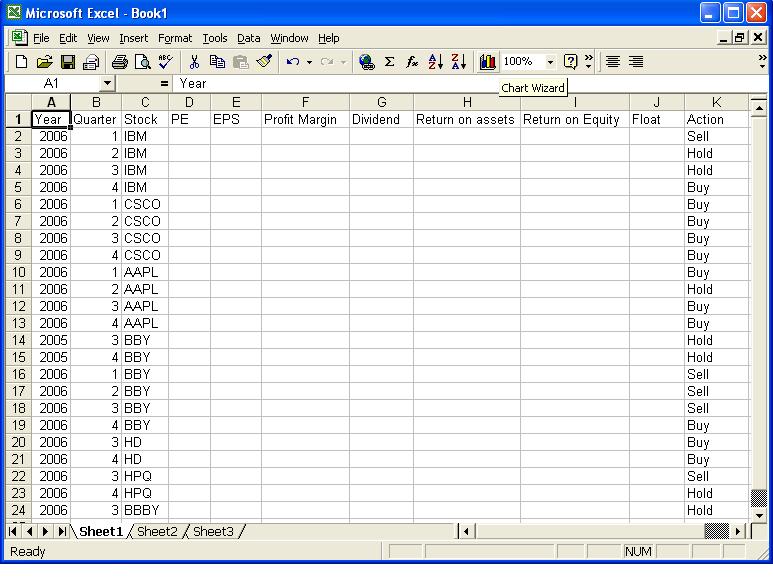

Here is a sample spreadsheet

which gives you a general idea of how NeuroShell Classifier training data would

be laid out. For clarity, we have not included the numeric fundamental

data. Also, the actions on which the net is trained (Buy, Sell, Hold) are

hypothetical actions which you would enter using any criteria you wish based on

the stock's future movement some number of months after the indicated year and

quarter when the fundamental data was recorded.

|